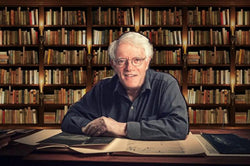

Global Financial Collapse: Vitalik Buterin

Share with Friends

Vitalik Buterin discusses the likelihood of a global financial collapse and the potential role of cryptocurrencies like Ethereum in such a scenario. He downplays the probability of a near-term collapse compared to his previous estimations, but argues that even without a crisis, cryptocurrencies can retain value due to their inherent properties and potential as a store of value. He emphasizes the importance of transitioning from proof-of-work to proof-of-stake mechanisms to address environmental concerns. He also suggests that the market will always find assets that act as long-term stores of value, and that cryptocurrencies might even offer societal benefits by reducing speculative pressure on assets like land.

Highlights

- 📉 Lower Probability of Collapse: Buterin believes the chance of a complete collapse of fiat currencies is lower than previously thought.

- 📈 Crypto’s Long-Term Value: Even without a financial crisis, cryptocurrencies could maintain and grow in value as a part of investment portfolios, mirroring GDP growth.

- ♻️ Proof-of-Stake Advantage: Shifting from proof-of-work to proof-of-stake is crucial to mitigate the environmental impact of cryptocurrencies.

- 🏠 Reduced Speculative Pressure: Cryptocurrencies could potentially reduce speculative pressures on real-world assets like land.

- 🛡️ Alternative Safety Net: In a crisis, cryptocurrencies could offer a safer alternative to failing traditional financial systems due to their inherent security features.