Redistribution of Wealth: Milton Friedman

Share with Friends

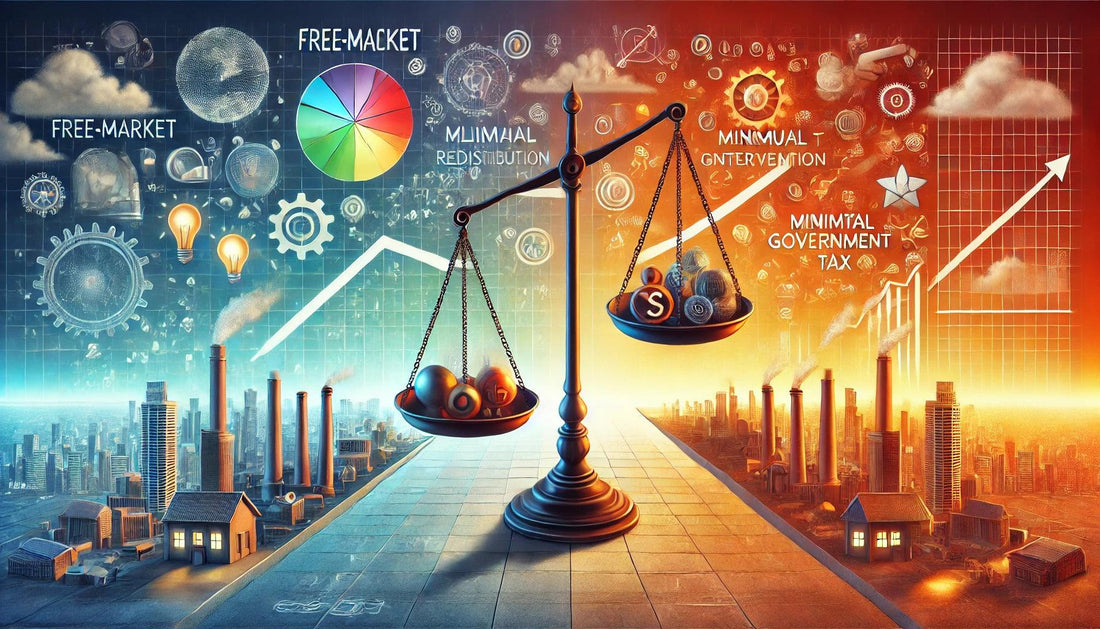

This video features a discussion with Milton Friedman regarding wealth redistribution. The core argument centers on the impact of inheritance taxes on incentives to accumulate wealth and the role of family in a capitalist system. Friedman argues against a 100% inheritance tax, believing it would stifle economic growth by eliminating the incentive for individuals to save and invest for future generations. He emphasizes the importance of family incentives in driving economic activity and the inherent “family society” aspect of even seemingly individualistic systems. He counters the idea that a 100% inheritance tax would be a neutral way to redistribute wealth, highlighting its detrimental effects on capital accumulation and technological advancement.

Highlights

- 👨👩👧👦 Friedman emphasizes the significant role family plays in driving individual economic incentives, viewing society as inherently family-oriented despite individualistic rhetoric.

- 💰 A 100% inheritance tax is presented as a counterproductive measure, argued to stifle wealth creation and investment due to the removal of incentives for saving and future planning.

- 🚫 Friedman contests the idea that a 100% inheritance tax is a neutral method of wealth redistribution, highlighting its potential to disrupt economic progress.

- 🤔 The discussion challenges the notion of a purely individualistic society, emphasizing the inherited advantages and disadvantages shaping individual economic trajectories.

- 📈 The conversation explores the relationship between wealth accumulation, family incentives, and the long-term health of a capitalist economy.