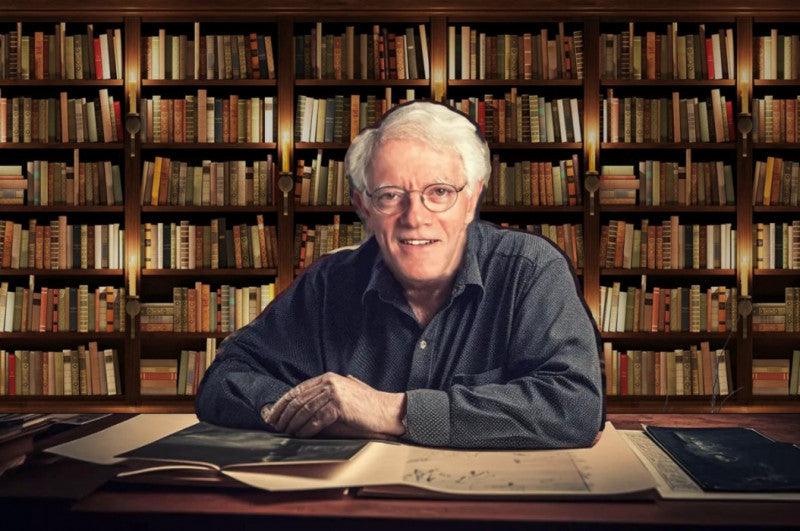

Investing Advice: Peter Lynch

Share with Friends

Peter Lynch discusses his investment philosophy of “investing in what you know,” emphasizing the importance of research and understanding the companies you invest in. He cautions against market timing and emphasizes the long-term perspective, advocating for holding onto great companies even during market downturns. Lynch highlights the potential for investors to identify undervalued companies, particularly those undergoing a turnaround, and stresses the need to avoid companies heading south. He uses examples from his own investing career to illustrate these points, including his experiences with Warren Buffett and his observations on industry shifts. Finally, he shares his current outlook on the energy sector, expressing skepticism about continued high production levels.

Highlights

-

📈 Know What You Own: Lynch stresses thorough research and understanding a company’s financials before investing, urging investors to avoid treating stocks like lottery tickets. He advises focusing on companies you understand, even within familiar industries.

-

🧘 Long-Term Perspective: He cautions against trying to time the market, noting that more money is lost anticipating downturns than actually experiencing them. He emphasizes the importance of a long-term investment horizon and the potential for significant upside over time.

-

💎 Identify Undervalued Companies: Lynch encourages finding companies within or outside the S&P 500 that are improving or poised for significant growth. He advises avoiding companies in decline.

-

🗣️ Warren Buffett’s Wisdom: Lynch recounts a conversation with Warren Buffett, who emphasized the importance of sticking with great companies and avoiding the temptation to sell them prematurely.

-

🛢️ Energy Sector Outlook: Lynch expresses caution regarding the energy sector, citing concerns about overproduction and a lack of investor interest. He sees potential for a slowdown in production and a subsequent price increase, suggesting a potential investment opportunity.

1. What are companies that you like?

2. Are you afraid of any Brands that you use that may not be around in 20 Years?